Earlier this year I found a TED Talks on the Future of Cash. As I work for Tellermate, and we talk about money a lot, I was excited to hear it. I enjoy learning others perspectives of cash, how they use it, how they think it will continue to be used, and how it is being used globally, but I will say I was a bit surprised on the concept that this talk brought up. The talk was given by David Birch, a British consultant and accountant that is a director of a company specializing in electronic money. This should have been my first clue as to the direction the talk was going in, but none the less, it’s good to see all sides of an argument, I know I don’t have the final answer.

Earlier this year I found a TED Talks on the Future of Cash. As I work for Tellermate, and we talk about money a lot, I was excited to hear it. I enjoy learning others perspectives of cash, how they use it, how they think it will continue to be used, and how it is being used globally, but I will say I was a bit surprised on the concept that this talk brought up. The talk was given by David Birch, a British consultant and accountant that is a director of a company specializing in electronic money. This should have been my first clue as to the direction the talk was going in, but none the less, it’s good to see all sides of an argument, I know I don’t have the final answer.

The main point I got out of his talk was that most of the cash in circulation was not being used to support any sort of global economy through people purchasing things, but instead to support the black market. So in turn, cash was hurting our economy because only criminals use cash.

Let’s think that through…

There is some validity to what he is saying. Pablo Escobar, the Columbian drug lord, was believed to have lost $1 billion of his profits a year to water damage and rats eating his cash. Now that’s a lot of cash laying around to be able to lose that much a year. And personally, I know I don’t carry around $100 bills in my wallet, but it is the 3rd most printed bill in the United States (1). Someone is carrying around stacks of $100s, hiding them under the bed or in the basement, a la rat food. There is no doubt, cash is still in the hands of many criminals but that doesn’t mean criminals are the ones using a majority of the cash in circulation.

There is some validity to what he is saying. Pablo Escobar, the Columbian drug lord, was believed to have lost $1 billion of his profits a year to water damage and rats eating his cash. Now that’s a lot of cash laying around to be able to lose that much a year. And personally, I know I don’t carry around $100 bills in my wallet, but it is the 3rd most printed bill in the United States (1). Someone is carrying around stacks of $100s, hiding them under the bed or in the basement, a la rat food. There is no doubt, cash is still in the hands of many criminals but that doesn’t mean criminals are the ones using a majority of the cash in circulation.

In 2014, 85% of all global retail payments were in cash (2). Not global theft, not global cash in circulation, but global retail payments. That’s actual items bought, taxed and given a receipt for. Not criminal in my book. Looking at another point, ATM withdrawals. I really doubt many criminals are using a bank or ATM to access their cash; doesn’t seem Pablo Escobar was. The global monthly cash withdrawals is set to rise to over 8.6 billion in 2015, representing $103 billion cash withdrawals per year. (3)

It looks to me that cash is on the rise and is being used by a multitude of people, not just criminals. In fact, 2014 was the year of the credit card fraud, and there was more talk of consumers turning back to cash for fear of fraud, criminals attacking electronic payments? Let’s look at some facts:

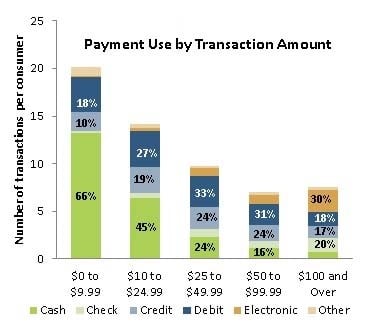

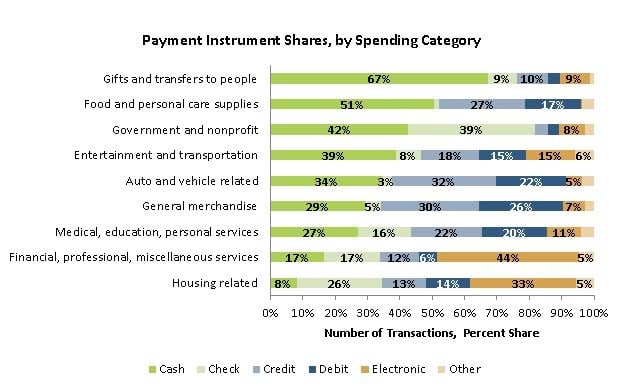

You can’t deny that credit card fraud is an issue. People are going to be wary to adopt a technology that is avidly being hacked by criminals. And I have no doubt that mobile payments and the complete adoption of EMV will have an effect on the usage of cash, and I welcome that change because it means more security in our payments. But, it doesn’t change the fact that cash is here to stay. $1.37 trillion (the amount of cash in circulation in the US as of June 4, 2015) isn’t going away any time soon and if the majority of it is in the hands of criminals, than that’s news to consumers who still prefer cash as the dominant option for low – value payments. (7)

|

You’ve got to give him credit, if I was the director of a company specializing in electronic money, I’d make the argument too. What do you think, is David Birch right? Are we headed towards a cashless society? Are criminals really the only ones using cash?