As household budgets tighten as the uncertainty of the pandemic continues, retailers and restaurants see ‘shrink’ (loss of cash or inventory due to internal theft, shoplifting, administrative errors, etc…) rising. A recent study carried out by the NRF highlights a number of problem areas, as well as measures that businesses are taking to combat this.

In 2020 shrink in the US reached an all time high at an average of 1.62% of NRF members, which equates to $61.7billion of losses. While 3 out of 10 retailers reported less than 1% shrink, 27% reported higher than 2% and 18% reported shrink to be above 3% in their companies. In competitive industries like retail, a shrink of 1 % equates to one-fifth of profit margins, so it’s easy to understand why this is such a key issue.

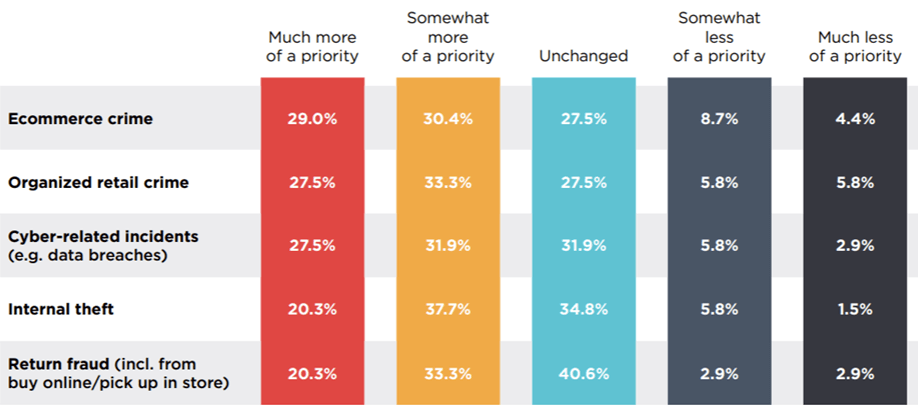

E-Commerce has seen an accelerated surge as a result of the Covid-19 pandemic, and while this improves accessibility and often reduces operating costs, it’s becoming an area of increasing interest in relation to shrink. E-commerce crime (payment fraud, chargebacks, etc…), return frauds (scams, on-sale goods, etc…) and cyber threats (data breaches) have been increased in priority by 60% of retailers. They also typically pose a far greater financial risk than shoplifting. The CCPA and GDPR means that fines for not respecting consumers’ rights around data privacy can escalate far beyond the impact of shrink, so it’s easy to understand why there’s such a focus on digital initiatives.

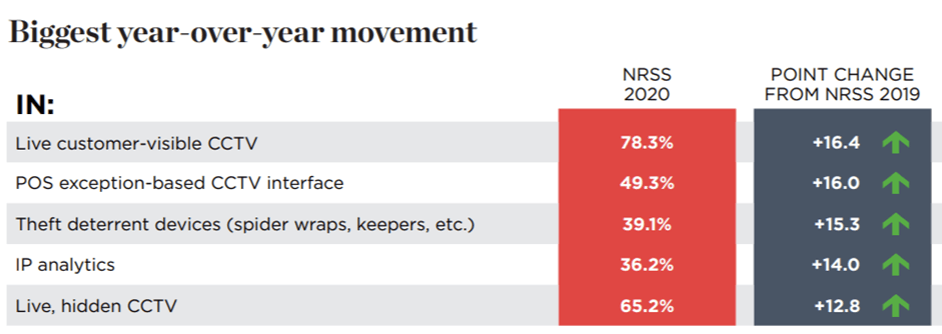

Having said that, the NRF research paper shows that only 26% of shrink occurs online, while 49% still occurs in store. Gift card scams, inventory theft and self-checkout loss is rising. This is fueled in the UK by police not investigating any shoplifting theft under £200, with similar laws in the US. With this in mind, it’s easy to see why NRF members have invested heavily in CCTV through 2020.

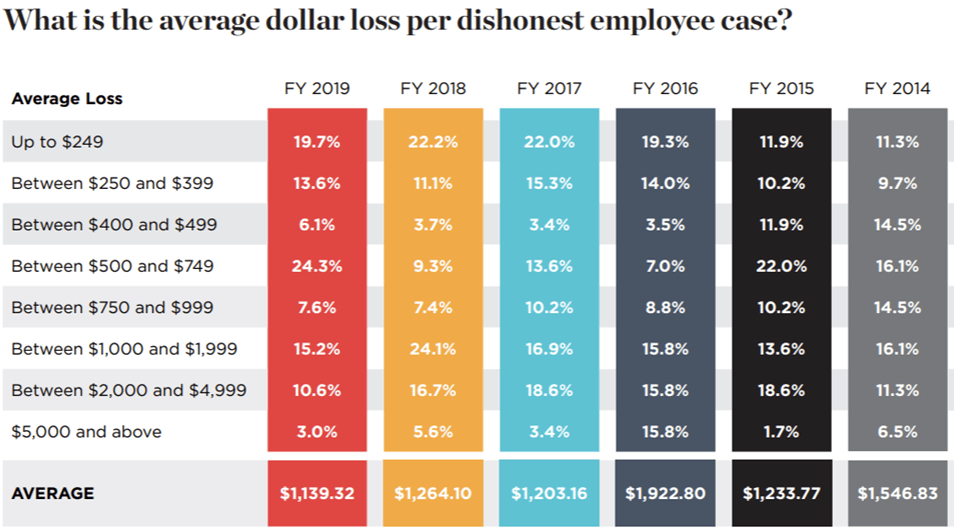

There is also another aspect of shrink to consider, one that most business don’t like to talk about because it’s uncomfortable, but employee theft is a big issue. While businesses have implemented measures to mitigate higher losses per employee and the average theft per case reduced in 2019, in 2020 there is an upward trend. This is particularly concerning as many businesses are moving towards online fulfilment which should lead to less opportunity for internal theft.

Tellermate are the experts when it comes to cash – Cash theft, cash reporting, cashier errors and more. We have solutions that address every step of the cash cycle, ranging from desktop money counters through to self-counting cash drawers and smart safes. These solutions are designed to satisfy a range of goals, including eliminating errors, minimizing theft and improving reporting. With over 40 years in the industry and a range of a clients from mom & pop stores through to Fortune 500 companies, you know that you can count on us.