Get ready for the polymer note. In the second half of 2016, the Bank of England will introduce polymer banknotes in the U.K. The new, more durable notes (bills to our U.S readers) will circulate for longer than the current paper notes – offering a better return on investment for the Bank of England and tax payers alike.

Get ready for the polymer note. In the second half of 2016, the Bank of England will introduce polymer banknotes in the U.K. The new, more durable notes (bills to our U.S readers) will circulate for longer than the current paper notes – offering a better return on investment for the Bank of England and tax payers alike.

However, with the biggest change to cash in the UK in over 40 years, comes the need to ensure that a whole host of cash processing and cash counting equipment across the UK is ready ahead of the introduction. So what is the impact of polymer on businesses, the public, and most importantly, on your cash management processes?

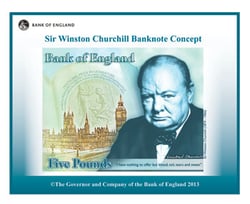

Firstly, let’s explain a little about what polymer banknotes are. The new notes are made from a polymer (often referred to as plastic) core, to which layers of inks and enhanced security features are applied.

The first note (the £5) is set to be issued in the second half of 2016 with the £10 set to follow in 2017. The Bank of England also recently announced its intention to extend the introduction of polymer to the £20 note.

There are several benefits to switching to polymer notes. The polymer or ‘plastic’ notes are less likely to become soiled and are around 2.5 times more durable than the current cotton-based paper versions. This means a tougher note that is less vulnerable to general wear and tear. For the issuing banks in particular, this is a sound investment. The change will lead to fewer rejections by cash processing equipment and a lower destruction rate. And, as they are expected to remain in circulation longer, the environmental dividend is greater too.

For the general public, the switch to polymer is a welcome change. Official Bank of England surveys of public opinion show a general excitement around polymer, and it’s easy to see why. Users will benefit from a note that is far better able to withstand punishing use – day in day out. The new notes are less likely to rip, become damp or dirty. Making them both easier and more attractive to use.

Similarly, the enhanced security features incorporated into the new notes will make counterfeits far more difficult to produce – reinforcing that even in the digital age, cash remains one of the safest methods of payment.

But the impact of polymer is far reaching. Manufacturers are in the process of ensuring their equipment is ready to verify and count the new polymer notes. Businesses ranging from ATM providers, to vending machine manufacturers, to weight based cash counter manufacturers will all need to make adjustments to account for the new size, features and weight of the polymer notes. The impact will vary from a simple software download to a hardware adjustment, or even replacement – this could have a cost implication for some end users.

One of the main challenges of polymer banknotes is that notes can stick together when new. For those who handle or manage cash, this could cause a number of problems as multiple notes could stick together and pass as one during processing or counting. For cashiers, this could potentially lead to missed notes. But even if your business manages to avoid this pitfall, simple processes such as counting (and re-counting) cash could be made more difficult.

The first step is to prepare. Familiarise your staff with the new notes and security features, and ensure this training takes place in good time to help ensure a smooth transition. Next, update and streamline cash handling and cash management processes.

Contact your suppliers to check for updates to any cash handling or cash management products or software. For manufacturers, make sure that any new products are fully compatible with the new notes, and that existing products and technologies are updated or replaced as soon as possible.

Use the introduction to streamline your cash processes with technology that will already deal with the new notes seamlessly. For those who count cash with Friction Counters especially, the introduction of the new notes could cause problems as the machines will struggle to deal with the resistance of the plastic notes – miscounts and errors are a real possibility and two notes passing as one is something that users should look out for.

Finally, consider alternatives such as weight based cash counters. These machines quickly count the notes by weight in batches rather than having to process each note individually. This way, even if the notes stick together, the count will be both fast and accurate.

For Tellermate customers, the transition can be seamlessly handled with a simple software update to your cash counting equipment. Customers will have already received the options available for doing so, and can contact us here for any further information.

It’s clear then, that although the switch to polymer will have a number of benefits for consumers and issuing banks alike. For businesses that process cash, the introduction of polymer banknotes could initially prove challenging. Updates to both processes and technology will need to be considered in order to ensure a smooth transition.

Ensure that cash management challenges don’t divert your attention from the growth of your business. And, that you have the most up to date equipment available for doing so. Contact your suppliers to upgrade technology and hardware, and consider investing in new, future-proof technology.